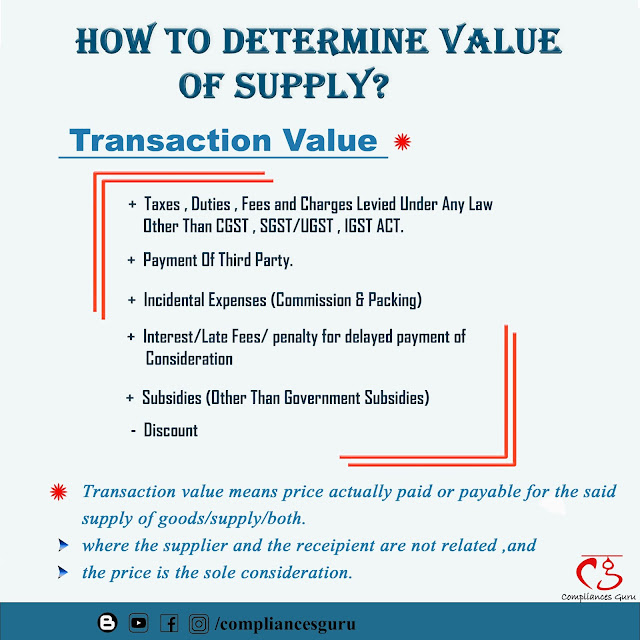

The value of supply shall include-

a) taxes ,duties, cesses,fees and charges levied under any law for the time being in force other than this Act, if charged seperately by the supplier;

b) any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of supply and not included in the price actually paid or payable for the goods or services or both;

c) incidental expenses, including commission and packing, charged by the supplier to the recipient of a supply and any amount charged for anything done by the supplier in respect of supply of goods or services or both at the time of, or before delivery of goods or supply of services;

d) Interest or late fees or penalty for delayed payment of any supply;

e) subsidies directly linked to the price excluding subsidies provided by the central Government and state government.

The value of supply shall not include-

Any discount which is given

a) before or at the time of supply if such discount has been duly recorded in the invoice issued in respect of such supply; and

b) after the supply has been effected, if-

(i) such discount is established in terms of an agreement entered intobat or before the time of such supply and specifically linked to relevant invoices; and

(ii) input tax credit as it attributable to the discount on the basis of documents issued by the supplier has been reversed by the recipient of the supply.

0 Comments